The SEM comprises three distinct areas that provide revenue streams relating to the services provided by market participants. The Energy Trading Arrangements (ETA), Capacity Remuneration Mechanism (CRM) and Delivering a Secure Sustainable Electricity System (DS3) make up the three main pillars of the market.

Energy Trading Arrangements (ETA)

The ETA are the activities comprising wholesale energy trading, which make up the major portion of revenue and cost for the majority of market participants. A key principle of the SEM is the flexibility it offers for those who wish to sell and purchase power. A number of markets each spanning different trading timeframes have been designed to enable increasing levels of competition that place a downward pressure on prices whilst ensuring that the supply of power matches demand.

The SEM Energy Markets are broken down between forward, Day Ahead, Intraday and the Balancing markets.

Forwards market

The Forwards market is a financial market. It provides participants with the opportunity to reduce their risk of exposure to significant movements in the price. These transactions can take place months to years ahead of the power being used. Products traditionally available in this timeframe include Contracts for Difference (CfD) between market participants or in the form of a Directed Contract (DC), whose price and volume is set by the Regulatory Authorities.

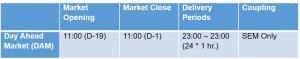

Day ahead market

Participation in the DAM is not mandatory, but it is the only way of achieving a day-ahead position in the SEM that will minimise their exposure in the balancing market. Participants have opportunities to adjust their position by trading in the intraday market.

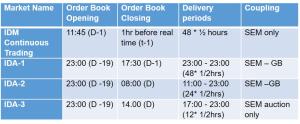

Intraday market

The intraday market (IDM) allows participants to adjust their physical positions closer to the time power is delivered. The IDM runs right up to one hour before trading and takes account of up to date market information including, for example, unscheduled plant outages or congestion on interconnectors.

The market consists of three daily auctions with IDA-1 and IDA-2 coupled with the GB market via the interconnectors. The third Intraday Auction (IDA-3) is a local SEM auction that is not coupled with the GB bidding area.

Balancing market

The BM is different from the other markets in that it reflects actions taken by the TSO to keep the system balanced and secure. Unlike the other ex-ante markets, participation in the Balancing Market is mandatory.

The BM trading day is divided into 48 (30 minute) imbalance settlement periods, within which are six (5 minute) imbalance pricing periods. The submission window for market data opens 19 days ahead of the trading day and closes 1 hour before the start of each 30-minute imbalance settlement period. The imbalance prices for each 5-minute imbalance pricing period are used to calculate the imbalance settlement price for each 30-minute imbalance settlement period.

A rules-based, flagging-and-tagging process is used to determine the initial imbalance price in each 5-minute imbalance pricing period. The flagging-and-tagging process prevents bids and offers that are scheduled due to a system constraint, or where units are operating at a unit constraint, from influencing the imbalance price.

Capacity market

The Capacity Remuneration Mechanism (CRM) allows generators to recover their fixed costs. It also helps to ensure there is enough capacity to meet demand and that this capacity is purchased at a competitive price via an auction.

The auctions are run a minimum of one year before the capacity is needed. Auctions for capacity required four years before delivery help to encourage new investment by providing a clear and pre-determined revenue stream. By promoting competition between market participants, it ensures payments more closely reflect the value provided by the capacity

The overall costs of these capacity payments are spread among suppliers. Those generators that do not deliver the capacity when needed are subject to a financial penalty.